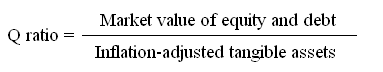

The ratio of stock price (i.e., market value of a company) to the current replacement value of a company’s tangible assets such as property, plant, inventory, equipment, cash, and investment in securities:

Generally speaking, a relatively high Q ratio (higher than 1.0) suggests an overbought market (for a company, it reflects the market’s assessment that the firm’s assets have a positive net present value (NPV)). Therefore, when this ratio is higher than 1.0, a company would have a strong incentive to invest (because the value of new investments would be positive). Q ratios less than 1.0 indicate that a company has overinvested in unprofitable assets.

This ratio was introduced by Nobel laureate James Tobin in .

It is also called Tobin’s Q.