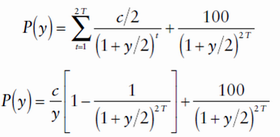

A special case of DV01 (actually it is similar to DV01), but it is based on the assumption that the yield of a fixed-income security is the interest rate factor and the price-yield relationship is determined as follows:

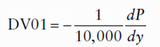

The above equation measures the price of a bond with annual coupon payment (c) per 100 face value, yield to maturity y, and years to maturity T. In essence, DV01 equals the derivative of the price function with respect to the rate factor divided by 10,000. The rate factor is the yield of the bond under consideration. Thus,

However, the yield-based DV01 can be interpreted as the (estimated) dollar change in bond price (per $100 in face value) in response to a one basis point change in yield. Yield-based DV01 assumes that the yield-to-maturity changes by one basis point while DV01, by definition, allows for any measure of rates to change by one basis point. Some market participants use a cocktail of names for DV01 measures according to the assumed measure of changes in rates. For example, the change in price after a parallel shift in forward rates might be called DVDF or DPDF while the change in price after a parallel shift in spot or zero rates might be called DVDZ or DPDZ.