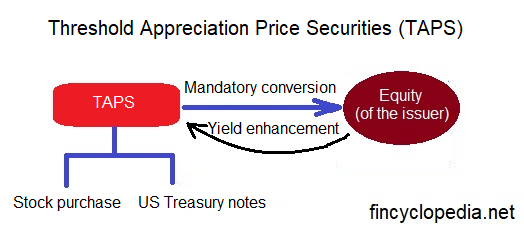

MedPartners Inc. issued 18,929,577 shares of threshold appreciation price securities (TAPS) on 09/15/97 at $22.1875 per share, which was also the selling price of the common stock of the company at that time. The mandatory conversion date of the TAPS was August 31, 2000.

Each security consists of (1) a stock purchase contract under which the holders are obligated to convert mandatorily to the firm’s equity on the mandatory conversion date and a commitment from the company to pay yield enhanced payments of 0.25% to the holders of the TAPS and (2) 6.25 % U.S. Treasury notes having a principal amount equal to the issue price and maturing on the mandatory conversion date. Thus each unit of TAPS pays a dividend of 6.5% per annum payable semi-annually, whereas historically the common stock of the company has not paid any dividends at all. Upon mandatory conversion each security was to be converted to a variable number of shares of common stock of the company. If the common stock price is less than or equal to the issue price of $22.1875, then for each unit of TAPS the holder will get 1 share of the company’s common stock.

If the stock price is between $22.1875 and $27.0678, then the holder will receive a number of shares that produces a value of $22.1875. If the stock price is greater than $27.0678, then the holder will receive 0.8197 ($22.1875/ $27.0678) shares of common stock per TAPS unit. Hence the cap of the TAPS is set at the issue price of $22.1875. Holders of TAPS also have an early settlement option, in which case they will receive 0.8197 shares of common stock per unit of TAPS regardless of the market price of common stock. Holders of TAPS have no voting rights, unlike the common shareholders.