A hybrid derivative instrument that is similar to a snowball. Actually, it is a snowball structured as a bearish note or swap by setting the increment (negative increment) of a corresponding accrual period equal to the difference between a CMS/ CMT rate (or a similar rate) and a given spread:

δt = Rt – st

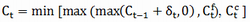

The coupon of this instrument can be capped and floored:

where Cc is the cap and Cf is the floor, both are typically bigger than zero. The coupon receiver, of course, is short the cap and long the floor. The coupon payer, in turn, is short the floor and long the cap.

The snowbear differs from its original form (the snowball) in that it involves a bet on rising rates, while the snowball is a highly leveraged bet on rates remaining low.