A credit default swap (CDS) entails the exchange of a floating recovery amount for a fixed recovery amount. For example, an issuer might be willing to pay the floating recovery amount and receive the fixed recovery amount. This swap is primarily designed to eliminate the uncertainty engulfing the cash settlement amount after a credit event has occurred. The counterparties to a recovery lock CDS can agree at the time of contract what the cash settlement amount will be in advance so that the return upon default can be locked in from the beginning.

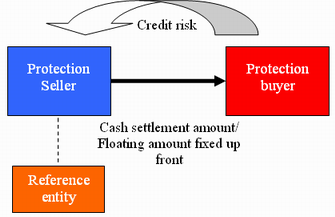

In the above diagram, the credit risk is conveyed from the protection buyer so that if default occurs a cash settlement amount is paid by the protection seller. This amount is a floating amount fixed at the time of contract.