An option contract that has another option contract as underlying. This product depends on volatility of volatility (vol-vol) and therefore experiences a large degree of convexity in its volatility. Therefore, this option is very sensitive to changes in volatility. In terms of construction, options on options (or compound options) are created in four different ways: call of call (cacall), call of put (caput), put of call (pucall), and put of put (puput).

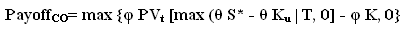

The payoff of a compound option, according to the Black-Scholes model, is given by:

Where: φ and Θ are binary variables (they take either values of 0 or 1), so that when the compound option is a call or a put, φ takes the value of 1 or -1, respectively, and when the underlying option is a call or a put, Θ takes the value of 1 or -1, respectively. S* is the the price of the stock that underlies the underlying option, Ku is the underlying strike price, K is the compound strike, t is the expiration date of the compound option and T is the expiration date of the underlying option.