The swap rate that makes a swap break even, i.e., renders its present value equal to zero. At this rate, the present value of the floating leg is equal to the present value of the fixed leg. To calculate this rate for a spot starting swap, it is necessary to start with calculating the present values of a swap’s two legs as follows:

where:

P is the discount factor

Tm is the swap’s maturity

Tj is the coupon date

C is the coupon rate

L is the level of the swap (i.e., the swap DV01).

The level of the swap is the product of the discount factors times the day count fractions (αj) corresponding to each semi-annual period, or the number of days based on a 30/360 day count divided by 360.

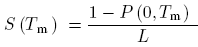

At the mid-market swap rate: PVfloating = PVfixed, therefore, the coupon on a mid-market swap is given by:

Comments