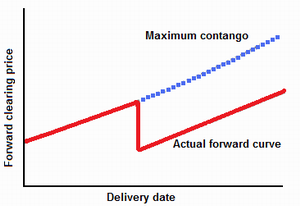

A situation of backwardation in which a specific period is “squeezed”, i.e., characterized by forced, not normal, trading. This usually results from speculative activity to force participants to buy back short spread positions at high prices. It may also result from a stock exercise to gain physical premium. Also, forward backwardation could simply be an outcome of the concentration of activity in a specific derivative product. This situation encourages near term selling and suggests that markets are currently pricing in some near-term tightness in a specific product or instrument. The pick-up in the forward backwardation suggests more forward selling. The following figure illustrates the structure of forward backwardation: