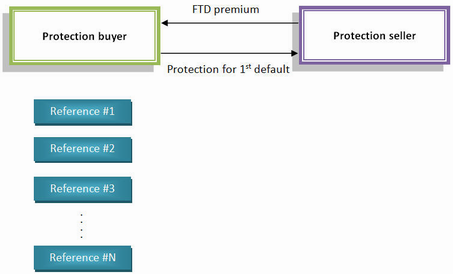

A basket default swap in which a payment by the protection seller to the protection buyer is triggered by the first name in the basket to default. Thereafter, the contract exists no longer. The following exhibit illustrates the structure of such a swap:

For example, a firm wants to hedge its exposure to a number of different reference entities (say N=4). Therefore, it enters into an first-to-default (FTD) basket contract with a swap dealer where the reference basket is made up of these four entities. As such, the firm is the protection buyer which will have to make periodic premium payments to the swap dealer (the protection seller). The dealer, in return, will be required to make a payment to the firm if and when any one of the reference entities defaults during the term of the contract. The payment will only be made for the first entity to default.