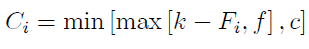

A floating rate note (FRN) in which the coupon is based on an inverse of a floating rate (capped and floored). The coupon is the lower of two variables: 1) the maximum of the difference between the strike price and the rate to which the instrument is linked (reference rate) or the floor level and 2) the cap of the inverse floating payment. The following formula illustrates this:

Where:

Ci is the i-th coupon of the callable inverse floating rate note

k is the strike price/rate

Fi is the reference rate

f is the floor of the inverse floating payment

c is the cap of the inverse floating payment