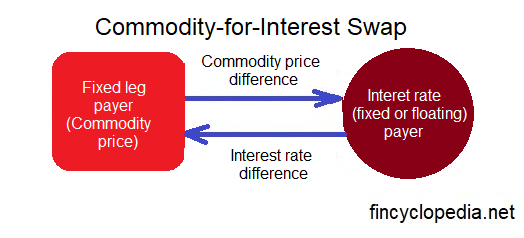

A swap (fixed-for-floating swap/ fixed-for-fixed swap) that entails payment of a return based on the commodity price against a payment leg that is linked to, or based on, a floating interest rate or an agreed-upon fixed interest rate. In this sense, is a combination of a commodity swap and an interest rate swap. The commodity-for-interest swap converts an interest rate exposure into a commodity price exposure or vice versa.

The commodity price (e.g., oil price, copper price, etc.) gets swapped for a floating or fixed interest rate over a specific period of time (swap term). As interest rate increases can impact the prices of specific commodities, using such a swap to hedge against this risk can be beneficial for certain market participants such as commodity producers and consumers.

For example, a commodity that need to be hedged is jet fuel. Airlines usually hedge fuel prices to establish a level of stability in their costs over a specific time horizon. Let us assume that as of August 20, 2023, jet fuel sold for approximately $2.90 per gallon. If an airline wants to hedge the price risk associated with its requirements of jet fuel, it may consider taking the fixed leg of a swap for five million gallons of jet fuel. Now, under one scenario, the price decreased to $2.80, the airliner would pay the difference to the floating leg holder:

Difference = (2.90 – 2.80) × 5,000,000 = $50,000

The airline could then buy 5 million gallons at a price of $2.80, while paying the 10 cents as a hedge against the price risk involved. The total cost would be equal to the original price at which the airline could have carried out its operations.

In the opposite scenario, if jet fuel increased to $4.00 per gallon, the floating-leg holder would pay the airline the difference:

Difference = (3.00 – 2.90) × 5,000,000 = $50,000

The airline could then buy the fuel at $3 per gallon, part of which would be financed by using the payment it received from the the floating leg holder, eventually only paying $2.90 per gallon. In either case, the company manages to stabilize its cost over the term of the swap.