A situation that arises when accounting revenues/ revenues equal (i.e., break even with) accounting expenses/ expenses, making net income (and pre-tax income) equal to zero. Accounting break-even reflects the amount of an entity’s sale of products or offering of services that will be enough to produce accounting revenues equal to accounting expenses.

With the effects of working capital held minimal or ineffective, at accounting break-even, net income (NI) is zero, so operating cash flow (OCF) will be equal to the periodic depreciation expense (dep).

OCF = NI + Dep.

OCF = Dep.

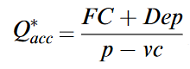

The accounting break-even quantity can be calculated using the following formula:

where:

FC is fixed cost; vc is variable cost per unit; p is price per unit. The denominator, (p–vc), is the contribution margin.

The accounting break-even quantity is defined as the sum of the fixed cost and depreciation divided by the contribution margin.

Accounting break-even is an indication of how much an entity needs to sell of its product or services so that its overall accounting profits are not impacted.

Comments