The instantaneous probability of default (conditional default rate) by an issuer. This risk management tool measures the probability of default on payment (or any credit event) in a short period of time conditional on no earlier default event. It is often used to measure default risk in bonds. In equation form, the hazard rate, denoted by λ, is the probability of default at any point in time (t), given no default prior to that time:

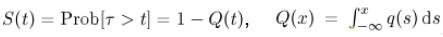

where: S(t) is the probability that the event time τ occurs after than any point in time, t:

q(t) is the density of default probability at any point in time (t):

As the hazard rate rises, the credit spread widens, and vice versa.

The hazard rate is also referred to as a default intensity, an instantaneous failure rate, or an instantaneous forward rate of default.

For an example, see: hazard rate- an example.

Comments