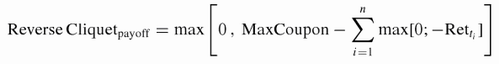

A cliquet option which gives the holder the right to receive a headline coupon adjusted for negative returns (instead of positive returns). That means the negative returns are deducted from the coupon over time. At maturity, the holder receives the remaining portion of the coupon after the deduction of the negative performances. Mathematically, the payoff of a reverse cliquet can be calculated using the following formula:

Where MaxCoupon is the headline coupon, which is usually a large above-market coupon that an investor can receive if the index has a positive performance every period (e.g. month) over the life of the option. Retti denotes the periodic returns of a typical cliquet.

As the coupon depends on the performance of an underlying index, the principal is guaranteed. Each cliquette in a reverse cliquet has a local cap and local floor, while the guaranteed redemption amount serves as a global floor.

Comments