Ijarah sukuk are the most widely used type of investment sukuk. They constitute certificates that carry equal value and are issued either by the owner of an underlying leased or leasable asset, or by the owner’s agent, to the effect that the leased/ leasable asset would be sold and its value would be recovered from subscription so that the sukuk holders become owners of the leased/ leasable assets. A sukuk holder will assume the rights and obligations of the owner/lessor in proportion to his holdings of sukuk. Ijarah sukuk are usually structured in two different ways: (1) sukuk are asset-backed and (2) sukuk are asset-based.

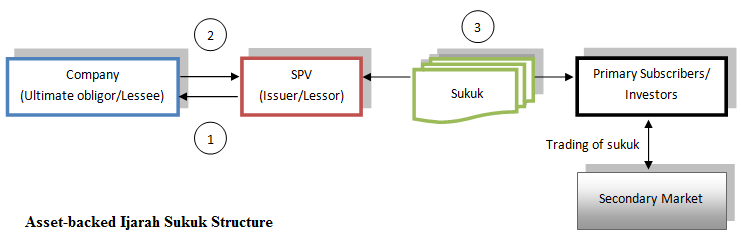

- Asset-backed ijarah sukuk: This is the most popular and widely accepted type of sukuk because it is structured through an asset-backed securitization and not as a debt obligation. In other words, this type of sukuk is backed by tangible assets where the originator/ company sells specific tangible and leasable assets to a special purpose vehicle (SPV) for the principal amount required for financing. However, the SPV itself doesn’t pay the price of the underlying assets. Rather, it raises funds by issuing sukuk to the investors and then uses the proceeds to purchase the assets. The sukuk represent the investors’ proportionate ownership in the assets and the lease. Thereafter, under an ijarah agreement, the SPV will lease the assets back to the originator/company for a pre-specified fixed amount and a particular maturity. The sukuk holders pay subscription proceeds to the SPV in return for their sukuk which will make periodic distributions. These distributions will be made out of the rental payments over the sukuk term which is concurrent with the lease term. The originator has the option to either pay the rentals periodically with a repayment of the principal at maturity (normal ijarah), or to repay the principal along with the rental payments periodically (lease to own or ijarah that ends with ownership transfer). The sukuk holder has the right to receive a portion of the rent according to his proportional ownership in the leased asset, while he bears losses to the extent of his ownership.

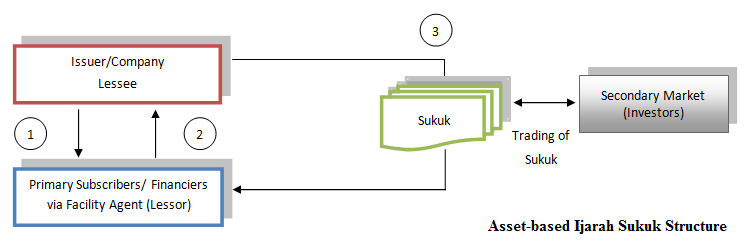

- Asset-based ijarah sukuk: Sukuk are structured in such a way that the issuer/company sells the leasable assets to a trustee or facility agent, acting on behalf of the primary subscribers, for the principal amount required to finance the purchase of the assets. The company issues the sukuk, rather than an SPV, to either the financiers, or directly to the investors. Then, the trustee, or facility agent, leases back the assets to the company. In the ijarah agreement, both the amount and maturity are predetermined and agreed upon.

The following table presents a comparison between the two structures of ijarah sukuk:

| Asset-Backed Ijarah Sukuk | Asset-Based Ijarah Sukuk | |

| Issuer | SPV | Company |

| Process | Securitization of tangible assets | Securitization of rental receivables |

| Characterization | Equity-like | Debt-like |

| Sources of payment | The revenues generated by the leased asset | The originator/ obligor’s cash flows |

| Sukuk holder’s ownership | Legal ownership with right to dispose of leased assets | Beneficial ownership with no right to dispose of leased assets |

| Recourse | Sukuk holders can recourse to leased assets | Sukuk holders can only recourse to obligor |

| Shari’a nomination | Because of its equity-like nature, this structure is considered shari’a-compliant | This structure involves both ba’i al-dayn and ba’i al-inah. Hence, it is not compatible with shari’a |