It stands for risk-adjusted return on capital; it is a uniform measure of risk-adjusted profitability that relates a specific formula of a bank’s revenue to its economic capital or a risk-adjusted return and capital allocated:

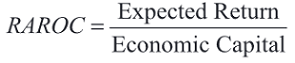

For a more realistic measurement, taking into consideration the fair value of capital, rather than its accounting value, RAROC is calculated as a ratio of expected return to economic capital:

In one version, RAROC is calculated as follows:

RAROC = (revenues – costs – expected losses – taxes)/ economic capital

This measure of capital accounts for income generated by capital and any expected losses associated it with capital deployment, where more risk is handled against higher expected returns.

The concept of such a capital measure was introduced in the late 1970s (by Bankers Trust) for the evaluation of profitability of its transactions and operations using RAROC as a common measure of risk.

It is also known as return on economic capital.