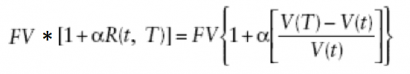

A bull note whose principal is not guaranteed (by a principal protection feature), as opposed to a protected bull note. By composition, this note consists of a zero-coupon bond and a forward contract on the underlying reference entity. Its payoff at maturity is given by:

Where: FV is the face value of the bond, α is the participation rate (percentage), R(t,T) is the reference equity price/ index over the lifespan of the bond, V(t) is the reference equity price/ index at a given time (t). One of the key determinants of the payoff at maturity is the participation rate that reflects the risk exposure of the note’s holder to underlying equity, and as a result would determine the reward at maturity (the realized percentage change in the underlying equity). For example, at a participation rate of 0.7 (or 70%), the holder will be exposed only to 70% of the realized percentage change.