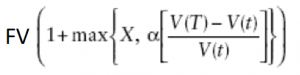

A bull note whose principal is protected (by the so-called principal protection feature), as opposed to an unprotected bull note. The add-on feature guarantees investors (holders) a minimum return. At maturity, the note’s payoff is given by:

Where: FV is the face value of the bond, X is the minimum return, α is the participation rate, and V(t) is the level of the underlying equity index at time (t).

By composition, a protected bull note has two components: 1) a zero-coupon bond and 2) a long call option. The latter allows the investor to benefit from upward moves in the underlying index, while the former guarantees the principal amount invested in the note.