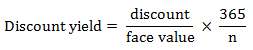

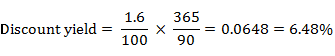

A discount instrument is one that sells at a discount to par value such as Treasury bills, commercial paper, and bankers’ acceptance. Such instruments quoted by market convention on a yield basis, rather than a price basis. The quoted yield is known as a discount yield, i.e., the discount related to par value. To illustrate, consider a Treasury bill whose maturity is 90 days and is selling at 98.4, i.e., at a discount of 1.6 from par. The discount yield is calculated using the following formula:

Where n is the number of days to maturity or the life of an instrument.

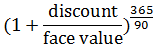

By market convention, yields are quoted on a simple interest basis, rather than an annualized compound basis. In other words, the discount to face value is multiplied by 365/n, rather than having it added to one and the resulting expression raised to the power of 365/90, that is

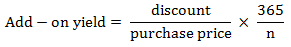

The discount yield, however, is not what an investor actually receives. In order to determine the amount received by an investor, the discount yield is typically divided by the invested amount, i.e., the purchase price of the instrument, all multiplied by 365/n or 360/n according to market convention. The actual yield on Treasury bills or similar discount instruments, the discount yield needs to be converted to an add-on yield:

For example, consider a Treasury bill with a 2% discount to par value and 90 days to maturity, then the add-on yield would be:

Add-on yield = (2/98) × 365/90= 0.08267= 8.267%