It has many meanings in multiple contexts. Generally, it is the interest rate that is charged over a funding interval, consisting of a fixed component and a premium.

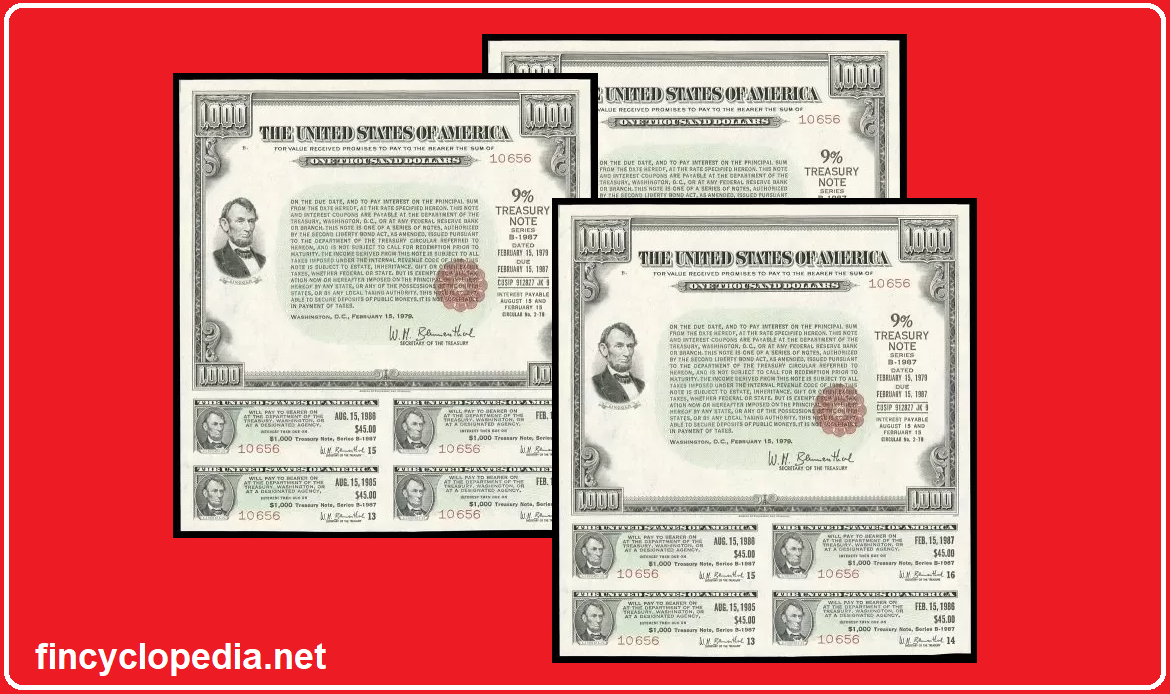

With respect to bonds, the funding rate of a bond is its cost of carry, i.e., the cost to buy and hold the bond. It determines whether it would be worthy for an investor to buy and hold the bond over a certain period of time.

In banking, it is the fee paid by banks and financial institutions in issuing financial instruments and certificates, e.g., savings, certificates of deposit (CDs), with the purpose of raising funds to extend loans. The difference (in percentage points) between a bank’s lending rate and funding rate is the so-called bank spread.

It is also known as a refinancing rate. It may also be referred to as cost of capital or cost of liquidity in specific contexts.