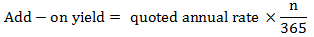

In general, it refers to interest that is paid at the maturity date of a loan when the borrower repays the lender the principal in addition to the accrued interest. More specifically, an add-on yield is a measure of yield that relates annual realized interest to original principal. It is typically expressed as a percentage. This measure is used for Eurodollars and other money market instruments that are traded on a yield basis such as Eurocurrency deposits, domestic interbank deposits and certificates of deposits (CDs). The naming is derived from the fact that the principal to be deposited is paid in full at the beginning of the period and is repaid at maturity with interest added on. The following formula is used to calculate this yield:

Where: n is the deposit’s life.

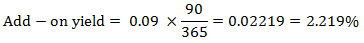

For example, consider a 90-day sterling domestic interbank rate is quoted at 9% per annum. The holding period return over the 90 days of the deposit’s life is the add-on yield:

This yield is sometimes known as add-on interest.