For an issuer, a fixed-income instrument is a form of debt that it is obliged to service (in terms of periodical interest payments) and repay (in terms of principal amount) at maturity date. This debt has priority over an issuer’s equity holders (of common shares, for example). For the investor (holder), it is a relatively low risk instrument as the payment obligation and redemption of principal is, under normal conditions, is guaranteed and precedes the rights of an issuer’s equity shares.

A typical type of fixed income instrument is a bond representing a loan extended by an investor (bond holder) to a borrower (bond issuer). Fixed-income instruments provide a predictable source of income, with the borrower (issuer) making payments on a predetermined schedule over the term of the instrument. In other words, this type of instrument allows the exchange of cash flows in a predetermined and periodic (fixed) timeframe.

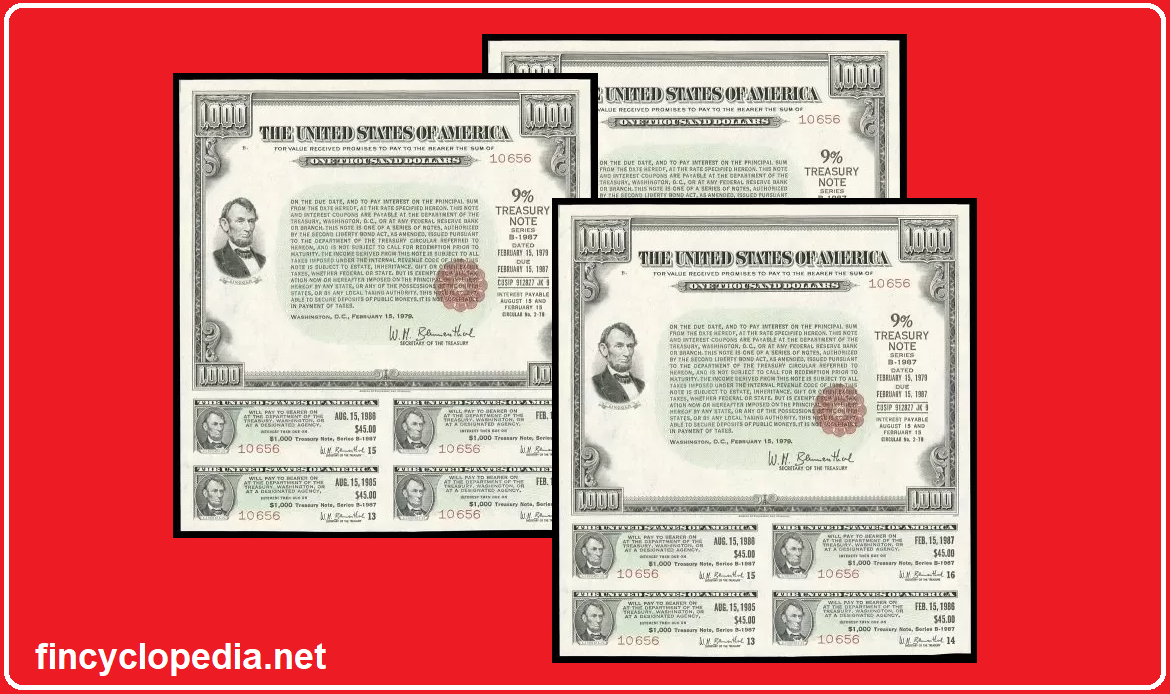

A fixed income instrument allows governments, companies, and local authorities (e.g., municipalities) to issue debt to the public in order to fund their activities and projects.

The types of fixed income instruments vary depending on arrangement between the two parties. Such instruments include certificates of deposit (CDs), government bonds, asset-backed securities (ABSs), specific types of derivatives (such as interest rate swaps, etc.)