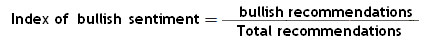

A contrary index that is based on how optimistic investment agencies (e.g., brokerage firms, investment banks, etc) are in recommending shares to the investment community. It relates the number of bullish responses (buy signals or messages or newsletters) to the sum of the bullish and bearish (sell signals or messages or newsletters) responses:

Based on the contrary opinion rule, the investor should follow a course of action opposite to the recommendations of investment advisory services. Advisory services are believed to be trader followers rather than anticipators (they recommend buying stocks at market bottoms and selling stocks at market tops. This index relates bullish investment advisory services to total investment advisory services.

This index, originally developed by A. W. Cohen, is published by Investors Intelligence. Investors Intelligence believes that when 42 percent or more of the advisory services are bullish, the market will move down. On the other hand, when 17 percent or less of the services are bullish, the market will move up. For example, if 45 out of 100 investment advisory services are bullish on the stock market, then the index of market sentiment equals 0.45 (45/100). Because 45 percent of the advisory services are optimistic about the prospects for stock, the investor is recommended to sell stocks. If bullish sentiment exists, a bear market is expected, and the investor should sell stocks owned. If bearish sentiment exists, a bull market is anticipated, and the investor should buy stock.