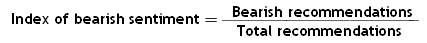

An contrarian index (a technical investment analysis tool) that simply reverses majority opinion as measured by recommendations of investment advisory services. Based on the contrary opinion rule, the investor should follow a course of action opposite to the recommendations of investment advisory services. Advisory services are believed to be trend followers rather than predictors (they recommend buying stocks at market bottoms and selling stocks at market tops). The index of market sentiment is calculated by relating bearish investment advisory services to total investment advisory services:

This index, originally developed by A. W. Cohen, is published by Investors Intelligence. Investors Intelligence believes that when 42 percent or more of the advisory services are bearish, the market will move up. On the other hand, when 17 percent or less of the services are bearish, the market will move down. For example, if 45 out of 100 investment advisory services are bearish on the stock market, then the index of market sentiment equals 0.45 (45/100). Because 45 percent of the advisory services are pessimistic about the prospects for stock, the investor is recommended to buy stocks. If bearish sentiment exists, a bull market is anticipated, and the investor should buy stock. If bullish sentiment exists, a bear market is expected, and the investor should sell stocks owned.