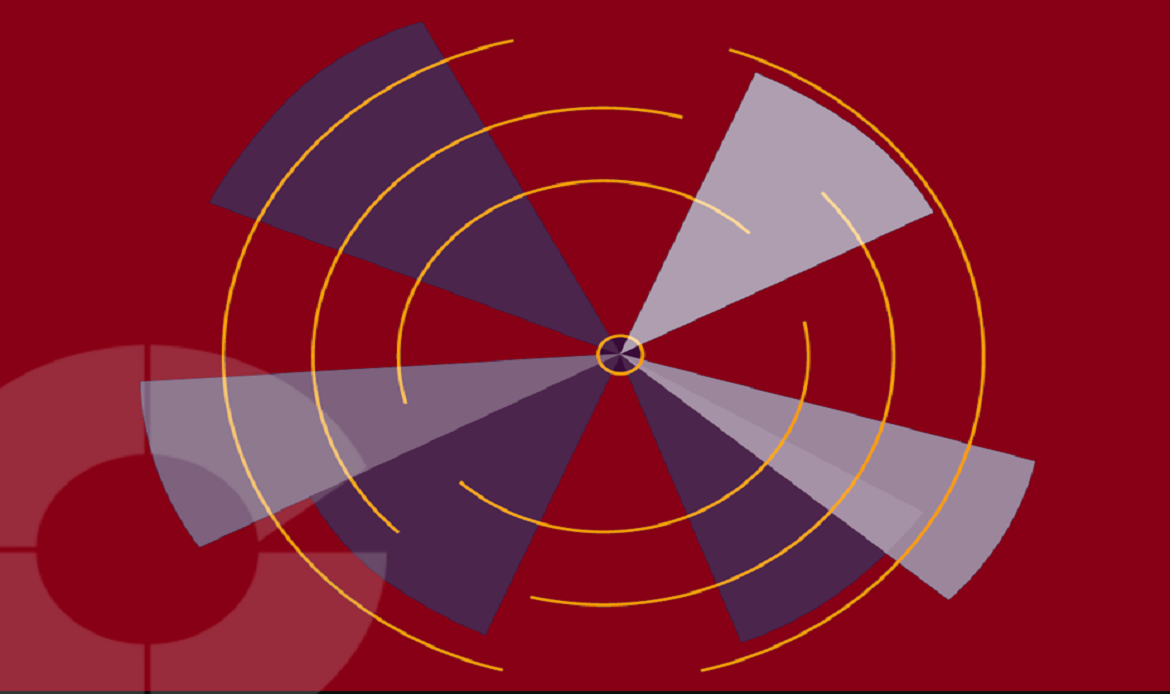

An algorithm (trading algorithm) that seeks liquidity at multiple levels of trading urgency. Traders using a capture (as a liquidity seeking algorithm) can fine-tune their trading parameters to market liquidity conditions, i.e., depending on supply in the market and the level and trading strategy selected by a trader. The capture algorithm can react live with changes in trading objectives. For example, a trader can set an order to passively seek block liquidity, or to actively work the order by defining a lit participation rate (levels: low, medium or high). An order can also be set to be executed on an urgent basis, i.e., at once.

The main parameters that can vary depending on a trader’s preferences including start time, end time, urgency (passive, aggressive, normal, etc.), price limit, price limit benchmark, price limit tolerance, etc.