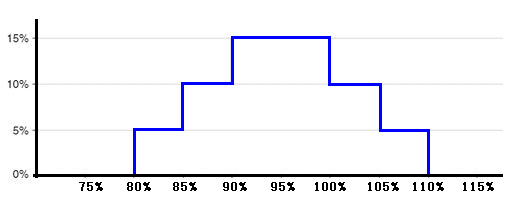

An option which pays a fixed payout based on the movement of the underlying reference rate within certain pre-defined barriers. It will typically pay a lower coupon where the reference rate moves within the wider range or no coupon if it touches the outside barrier levels. This structure is equivalent to a set of two-sided no-touch digitals. The following figure is an example of a possible graphical illustration of the payoff of a wedding cake.

In the above depiction, the wedding cake structure pays a 15% coupon at maturity, on the condition that the underlying remained within the range [90%, 100%] (this range represents the uppermost tier of the structure). It pays a coupon of 10% if the underlying slides outside the first range but does not leave the second range [85%, 105%] (the middle layer of the structure). It pays a coupon of 5% if the underlying has traded through the second range but remained within the third range [80%, 110%] (the bottom layer), and it pays nothing otherwise (i.e., if the underlying has broken through the third range).

This structure can be viewed as a combination of three two-sided no-touch digitals which functions as follows: initially it is a digital that pays 5% if the underlying remained within the range [80%, 110%]. Thereafter, the structure allows in a second digital that also pays 5% if the range [85%, 105%] is never traded through, and another no-touch digital with a payoff of 5% and a range of [90%, 100%]. In this sense, a wedding cake can be priced by first pricing each layer separately and then adding up the values of the three layers .

In practice, the layers of the cake can be any other number than 3 (say, 4 or 5, etc).

Comments