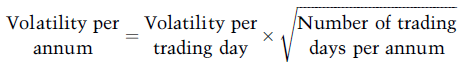

A volatility measure that takes into account, in estimating volatility from historical data, only the days when an exchange is open and ignore the days when it is closed. This measure is also used when calculating the life of an option. Empirically, volatility is found to be remarkably higher at trading times than when an exchange is closed. The volatility per annum is typically calculated using the volatility per trading day multiplied by the actual number of trading days per annum:

The number of trading days in stock exchanges varies across countries according to country-specific considerations (in the U.S.A, it is assumed to be 252 days).

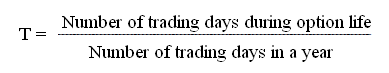

In order to determine the actual life of an option, trading days are usually used instead of calendar days, as shown in the following formula, where T denotes years:

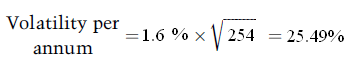

For example, if an investor thinks that the underlying stock has a volatility of 1.6% per trading day during the life of an option (or its time to expiration), and there are 254 trading days in a given year, then:

The higher the volatility the higher the price of an option, and vice versa. In this example, if the market thinks volatility will be 23%, this would imply that the investor considers the option is worth more than its market price, then he should buy the option.

Comments