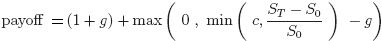

A structured product which has a cap applied to total returns. At maturity, the payoff of one unit of face value of a globally-capped product can be given by the following formula:

Where: g is the guaranteed return (local floor), c is the global cap, T is the time to maturity at issue, and ST denotes the level of the underlying price index at time t. Globally capped products don’t pay dividends and are usually based on a market index that doesn’t include dividends (e.g. S&P 00).

The contract’s return over its time to maturity belongs to the range [g, c], where c> g > -100%. The global cap comes into effect if the underlying index performs well, especially when the return over the product’s life exceeds the global cap rate (c). This cap pays for the global floor.