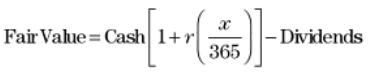

The fair value of a stock index futures is the theoretical value that accounts for the current index level, index dividends, interest rates, and days to expiration. In calculation, it is given by:

Where x denotes days to expiration, and r is the relevant interest rate.

The actual futures price fluctuate around fair value due to fluctuations in short-term supply and demand. Price fluctuations create an arbitrage window and thus help drive the actual price closer to fair value.