An entity in which another entity owns or holds a minority interest (non-controlling interest). An investment in an affiliate is one in which an entity owns a non-controlling stake (i.e., between 20% and 50% of the shares), implying “significant influence” which entails that the affiliate is accounted for under the equity method of accounting.

Non-controlling interest is usually classified as active non-controlling interest or passive non-controlling interest. In passive interest, the non-controlling stake usually doesn’t exceed 20%, in which case a entity cannot exercise any influence over the other. On the other hand, the stake of an active interest ranges between 21% and 49%, and an entity with such active interest would have voting rights whereby it can influence the other entity.

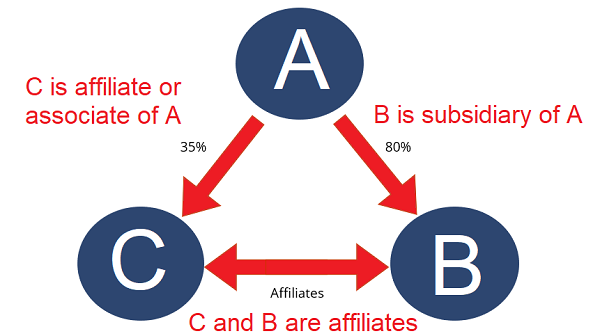

An affiliation can also take the form of a relationship between two different entities, where both are subsidiaries or associates of the same parent. In this context, the terms “affiliate” and “associate” have the same meaning. However, while all associates are affiliates, not all affiliates are considered associates.