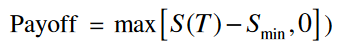

An option (specifically, a lookback option) that gives the holder the right to buy or sell the underlying asset at the best price achieved in the lookback window or monitory period (applying the lookback feature). A floating strike lookback call gives the holder the right to buy the underlying asset at the lowest price observed, in the life of the option. The payoff of the floating strike lookback call options depends on the minimum asset price reached during the life of the option and underlying asset price observed at the option’s maturity date.

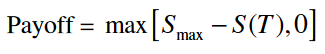

Similarly, a floating strike lookback put gives the option the right to sell the underlying asset at the highest price observed, in the option’s lifetime. The payoff of the floating strike lookback put options depends on the maximum asset price reached during the life of the option and underlying asset price observed at the option’s maturity date.

Comments