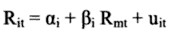

The weighted average of betas of stocks or businesses in the same industry group. It is a proxy for systematic risk (beta) that is similar for all businesses in a specific industry. This value of beta is typically used in such cases where a given stock or market is less liquid or has a very short history (historical data). Industry betas are also quite instrumental for private companies and business units (whose individual betas are, by nature, hard to be figured out, if any). Industry beta values can be calculated using a single factor capital asset pricing model:

Where: Rit is the industry return, αi is the alpha return, βi is the industry beta, Rmt is the return on a broader index (market return), uit is the residual.

An industry betas can be viewed as a portfolio beta which is the weighted average of betas of portfolio components. The standard error of portfolio beta is generally lower than that of the betas of individual components.

Comments