LIBOR or the London interbank offered rate is the rate at which international banks charged each other for money borrowed or lent among themselves on an overnight basis. In other words, LIBOR was an index that measured the cost of funds to large international banks operating in London financial markets or with London-based counterparties. The British Bankers Association (BBA) compiled the interbank borrowing rates of panel banks and calculates the average rate for different maturities (the shortest maturity is overnight, the longest is one year.). The rate was published noon every day for various currencies (the dollar, the euro, the Swedish krona, the Danish krone, etc). In everyday business, borrowing companies and institutions were charged the LIBOR plus a specific number of basis points depending on their creditworthiness (for example, LIBOR + 1% or LIBOR + 100 basis points). LIBOR interest was computed on an actual/360-day basis.

Until February 2011, the US dollar LIBOR panel was formed of 16 banks and the rate calculation for each maturity axed out the highest four and lowest four submissions. In order to figure out the officially published LIBOR, an average of the remaining eight submissions was calculated. Currently, the BBA surveys, each day, a panel of 18 banks (major global banks for the USD LIBOR). The BBA excludes the highest 4 and lowest 4 submissions, and averages the remaining middle 10, producing a 23% trimmed mean. The average is published at 11:30 a.m.

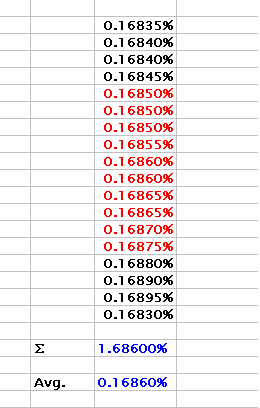

For example, one-month USD LIBOR submissions on a given day were: 0.16850%, 0.16860%, 0.16865%, 0.16850%, 0.16845%, 0.16840%, 0.16850%, 0.16865%, 0.16875%, 0.16880%, 0.16855%, 0.16860%, 0.16890%, 0.16895%, 0.16870%, 0.16840%, 0.16835%, and 0.16830%. Then, the average value of the middle 10 submissions (excluding upper and lower extreme values) is calculated as follows:

The average value of 0.16860% would be officially published for the respective day.