The coupon equivalent rate is a measure of yield that is typically used to make discount instruments (ones that are usually quoted on a discount basis) comparable with those quoted on the return on investment. Using the coupon equivalent rate as a basis for stating interest is particularly useful for Treasury bills and commercial paper which are conventionally sold at discount from par value.

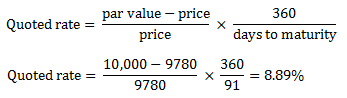

For example, a $10,000 Treasury bill that matures in 91 day and is currently selling for $9780 is said to be currently quoted at:

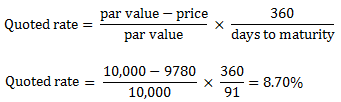

However, if calculated on the amount of money invested, the coupon equivalent rate would be: