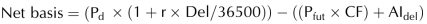

The basis amount that results from adjusting the gross basis for net carry. Net carry is the actual coupon income of a bond in addition to its re-investment minus borrowing costs (which are calculated at the money market repo rate). A positive net basis reflects the net cost that a long cash/ short futures position would incur, while it reflects the expected gain for the short cash/ long futures position (where the actual repo rate is the reverse repo rate). The net basis is given by:

Where Pd is the bond dirty price, r is the repo rate, Del is the days to delivery, Pfut is the futures price, CF is the conversion factor, and AIdel is the accrued interest to delivery.

The net basis represents the true economic basis. Brokerage firms usually quote bonds on a net basis, i.e., the price quoted to investors includes a mark-up in lieu of a commission.