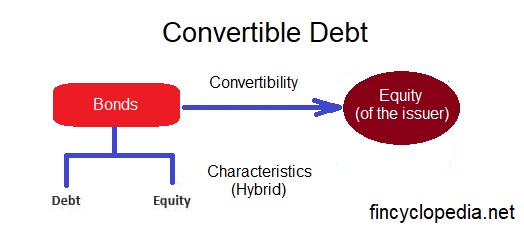

A type of debt (financing) that can be converted equity shares of the issuer at or after a certain time over its maturity. An example is a convertible bond, that constitutes a debt instrument that can convert into equity shares according to the terms set out in the issuance documents. It is a hybrid security as it combines debt and equity features and provides the holder with more flexibility as to the ability to change its position over it maturity.

Convertible debt is an attractive alternative for investors who seek to earn interest in the short term, while enjoying convertibility to equity in case the issuer’s share price improves in the future. Issuers can also obtain a lower interest rate on their financing.

Conversion takes place at or below a specific valuation cap (conversion cap). Convertible debt instruments typically offer a discount and a valuation cap. The instrument converts into equity at a conversion price equal to the issuing company’s valuation in the next round of financing. A valuation cap results in the conversion of the amount invested into equity at a maximum price (even if the value of the company at the next round of financing exceeds the level of the cap). For example, if the valuation cap was set at $2 million but the company’s valuation at the next financing round was $2.5 million at the time, the amount invested would convert into equity at the $2 million valuation cap.