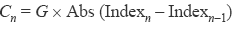

An interest rate product which pays a coupon linked to the absolute volatility of an interest rate index over a specific period of time. In volatile markets, the note holder takes advantage of changes in the underlying index, regardless of direction. The coupon of a volatility note is given in the following formula:

This instrument helps long-term bond investors to establish a natural hedge, i.e., to mitigate the effect of negative volatility on their investments. If rates increase, the value of bonds goes down, whilst the fall of rates would hinder any feasible rolling over of available funds.