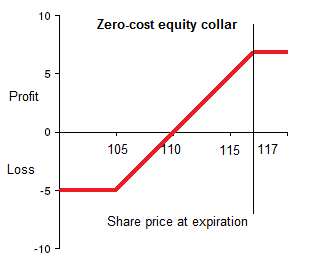

A zero-cost equity collar is one that results in zero net premium. The following example illustrates how this strategy works:

| Contract | Expiration | Strike Price | Premium |

|---|---|---|---|

| Long Put | 3 months | 105 | -5 |

| Short call | 3 months | 117 | +5 |

The above table summarizes a package of options traded by the investor with his dealer. The two strike prices represent the lower and upper limits of the collar. The strike price on the call is capped at $117. The maximum loss is $5, incurred when the share price has fallen from $115 to $110. For prices lower than $110, the investor will receive compensation on the $110 strike put option to offset any losses on the share. The maximum gain is $7, attained when the share price has risen from $110 to $117. After that level profits are capped. Accordingly, this collar provides a reasonable deal of protection with no net premium to pay. It is shown in following figure: