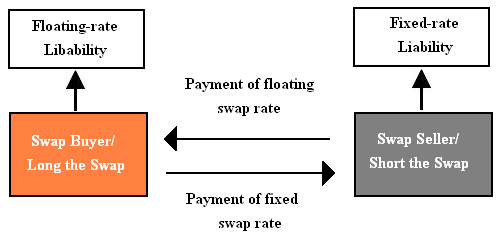

A swap can be used for hedging a floating-rate liability and a fixed-rate liability. Economically, a swap produces the same effects of a pair of back-to-back loans. In order to hedge a floating-rate liability, an investor can create a position that is long the swap (i.e., that of a buyer or a fixed-rate payer). This position is equivalent to borrowing fixed-rate and lending the money on at floating rate. To hedge a fixed-rate liability, the investor can construct a position that is short the swap (i.e., the seller or the floating-rate payer). In the same token, this position is equivalent to borrowing floating-rate and lending the loan on at a fixed rate. The following diagram demonstrates these two cases.

Though the two instruments (back-to-back loans and swaps) can bring about the same financial effects, swaps in particular enable investors to reduce credit risk to a larger extent than back-to-back loans do. Furthermore, the loan principal may inherently be a source of substantial risk (repayment risk) in case of default by a borrower. In contrast, the notional principal of a swap is by nature “notional” rather than monetary, and hence it is not vulnerable to default risk (actually, it is only used a basis for calculating interest payments). Also, in swaps, the netting of swap coupons eliminate a great deal, if not all, of the risk associated with the interest payments at fixing dates.