The swap market allows borrowers (especially those at a disadvantage to borrower from banks) to lock in the best rates on their debt financing. Customarily, banks and other financial institutions lend money (specifically floating-rate loans) at a spread over LIBOR. In reality, lenders do their best to ensure the spread is a high as possible, while borrowers attempt to have it as low as possible.

The spread size depends on a mix of subjective and objective factors including a borrower’s financial solvency and credit history, a lender’s liquidity and willingness to lend, the supply and demand of funds in the broader financial market (which in turn affects the level of interest rates), among others. Disadvantaged borrowers, those who are denied access to bank loans or unable to borrow at low rates, can enter the swap market to improve the borrowing terms in a synthetic fashion.

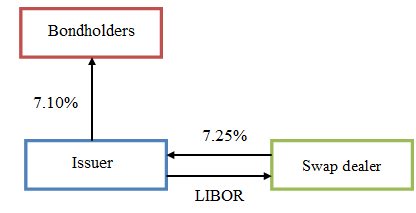

For example, a firm wants financing and is offered LIBOR+100 on a floating-rate loan. However, it feels that it should have been able to borrow at a lower rate given its high creditworthiness. Suppose the firm issued a 5-year bond at a fixed rate of 7.10% (actually it locked in this rate for the life of the bond). Unfortunately for the firm, rates dropped after one year. Therefore, it entered the swap market and received 7.25% against LIBOR. In this way, the firm can pay, for the remaining life of the bond, LIBOR- 15:

Effective rate = LIBOR – spread = LIBOR – 15

| Interest on bonds | (7.10%) |

| Swap fixed rate | 7.25% |

| Swap floating rate | (LIBOR) |

| Effective rate | (LIBOR- 15) |

The synthetically created rate is illustrated below:

Overall, the firm, by using the swap market wisely, could save 110 basis points (100 on the best floating-rate offer and 10 from the synthetic sub-LIBOR rate).

Comments