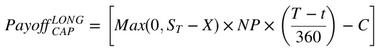

A long cap is a cap held by the purchaser (the long) against payment of the cap premium to the seller (the short). The payoff of a long cap is the larger of the difference between the current market price (current market rate) and the strike price (strike rate) or zero, at the time of expiration (for European style contracts):

Where:

X is the strike price/ rate (i.e., the locked-in cap rate).

ST is the current market price/ rate (the price/ rate prevailing at the time of exercise or at expiration date).

NP is the notional amount of the cap.

C is the cap premium (option premium for a cap).

T- t is the number of days to maturity.