Gearing (or leverage), in the world of finance, is a double edged sword. It works both ways- for the investor if things go right, and against him otherwise. Due to their very nature, options give investors big gearing to underlying price movements. The source of gearing in derivatives varies from one type to another. In swaps, gearing results from the notional financing, while in futures contracts, it is usually caused by the margin mechanism. Still, in the case of options, it arises from an entirely different source: the purchase price or the premium paid in order to acquire the right to exercise. The following example demonstrates how gearing in options works.

Suppose the XYZ share price is currently at $50, with a recent trading range of $45 to $65 and a current volatility of 35%. Also assume that the non-dividend-paying share has had its historical volatility within the range [30% – 50%]. An option trader is offering an ITM call option on this share which expires two months from now for a price (premium) of $4. Market interest rates are 3.9%. The share is expected to trade at $60 in two weeks time which marks the company’s periodical results announcement. At that time, the call option will have 46 days prior to expiration. Assume that volatility accordingly increases to 50%. Using the Black-Scholes model, and assuming an exercise price of $47, the option would be worth $13.57.

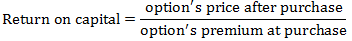

The profit that an investor can make from pure equity investing is the increase in the share price (in this case: from $50 to $60, or a gain of 20%). However, the profit can be geared up using options; in our example, the return on investing in the option (outlay is the premium) can be computed using the following formula:

The option’s price moved up from $4 to $13.57, or a percentage gain of 339.25%. The option’s price after purchase is $13.57, whilst the option’s premium at purchase is $4.

Gearing in both directions would be lower if the option is at the money at the time of purchase, i.e., it has some intrinsic value. But still, the option will cost the buyer more. The risk will be less, but the buyer will need to commit more capital, and the potential return will be lower if everything ends up well.