In the realm of finance, gearing (or leverage) has both its advantages and disadvantages. As far as derivatives are concerned, investors have at their disposal a powerful tool to gear up profits ( and also losses). The gearing is either inherent to the derivative itself as in the case of options or arises because of the way of trading, as with futures. The gearing element in a futures contract can be deduced from the fact that futures exchanges allow investors to trade their contracts by posting a fraction of the position’s value as collateral (known as margin). If the price moves up, this feature will cause the return on capital to gear up (increase more than proportionally). However, the gearing works both ways: if the price drops, losses can also be caused to gear up or increase more than proportionally. Therefore, it is often said that an investor can double his money, or be wiped out by a small increase or decrease in the underlying price.

The following example illustrates how gearing works in futures contracts. Suppose the bid-ask of a futures contract on a given stock market is currently standing at 49-50. If the initial margin is 20%, an investor could buy one contract at 50, for a total value of $500 and a margin of $100. If prices move up so that the bid-ask becomes 59-60. The investor can sell one contract at $59, for a total value of $590. As a result, the profit of this trade is

Trading profit = position’s terminal value – position’s initial value

Trading profit = 590 – 500 = $90

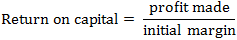

The return on capital the investor earn using futures is calculated using the following formula:

Return on capital = 90 / 100 = 90%

The gearing effect is, thus, 90% even though the actual futures price only moved up from 50 (asked) to 59 (bid) or 18%. In other words, the effect of gearing is 5 times the price increase (5 times more proportional). In this sense, the gearing in futures allows investors to gain substantially higher exposure than their capital would normally permit. In short, the higher the stake in a futures position, the higher the profit or loss would be.