A floating-rate loan can be synthetically constructed using interest rate swaps. A debtor with a fixed-rate loan can convert his loan into a floating-rate loan (in order to hedge against foreseen decreases in interest rates) by entering the swap market to unlock the interest rate. This is usually done by concluding an interest rate swap in which the debtor pays floating and receives fixed. The following example illustrates how such a loan can be synthetically constructed.

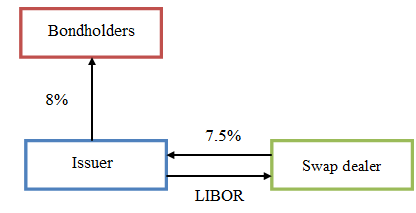

Suppose a firm managed to place a $100 million bond issue for five years at a fixed rate of 8%, expecting rates to rise. However, after a year, rates seemed to be following a downward trajectory. Therefore, the firm contemplates converting this loan into a floating-rate loan in order to free itself up from the fixed-rate commitment. As prepayment is virtually not a viable choice due to the hefty penalties stipulated in the loan agreement, the firm decides to use the swap market to convert this loan. The remaining life of loan, i.e., four years, will also be swap’s time to maturity.

The swap agreement requires the firm to pay floating (LIBOR) and receive a fixed rate of 7.5%. As such, the effective rate of interest the firm will be paying is:

Effective rate= swap rate + spread = LIBOR + 50 bps

| Interest | 8% |

| Swap floating rate | 7.5% |

| Swap fixed rate | (LIBOR) |

| Effective rate | (LIBOR+50) |

Thanks to the swap, the firm could turn its 8% fixed-rate loan into a synthetic floating-rate loan of LIBOR+ 50 bps.

In absolute terms, if LIBOR is currently at 7.6%, that would imply a cost savings of 40 basis points. As long as LIBOR is decreasing, as predicted, the firm would have more of these savings.