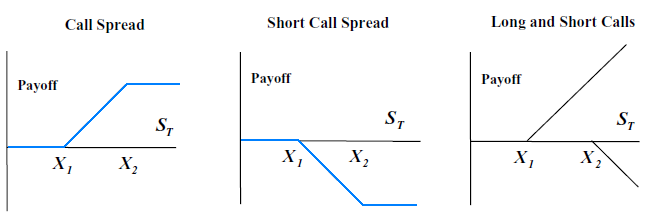

The call spread is an option combination that constitutes a modified version of a call option. By definition, it is an option spread which involves buying a call with a given strike price and expiration date while short selling another call with a different strike and expiration date, on the same underlying. The payoff is similar to that of a call option except that it only rises to a specific level and doesn’t exceed it. The following figure (the graph on the left) shows the payoff pattern of a call spread:

The payoff is zero as long as the underlying price is at strike X1 or below. Beyond that level, the payoff starts to increase until the underlying reaches the level of strike X2, at which point it no longer gains in value. In this sense, a call spread can be created by combining vanilla options. The second graph illustrates the payoff diagram of a short call spread; it is just the mirror image of the long call spread with respect to the horizontal axis. The third graph demonstrates how a call spread results from a combination of a long call (strike X1) with a short call (strike X2).

A call spread has many variations including: a bear spread, a bull spread, and a calendar spread.