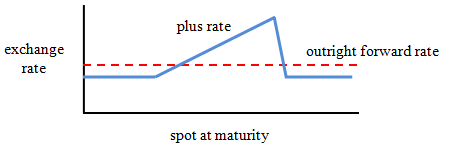

A forward contract that allows firms to fix a forward price while benefiting from a predicted spot movement. It establishes a certain range of profit potential, while maintaining a worst case level close to the forward rate. This structure is composed of a forward contract with a forward price as the worst case and a reverse knock-out, whose payoff profile resembles a shark fin, as shown below:

There are two kinds of shark forward contracts: shark forward plus and shark forward extra.

A Shark forward is sometimes known as a forward plus, a forward extra, and an enhanced forward.