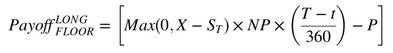

A long floor is a floor held by the purchaser (the long) against payment of the floor premium to the seller (the short). The payoff of a long floor is the larger of the difference between the strike price (strike rate) and the current market price (current market rate) or zero, at the time of expiration (for European style contracts):

Where:

X is the strike price/ rate (i.e., the locked-in floor rate).

ST is the current market price/ rate (the price/ rate prevailing at the time of exercise or at expiration date).

NP is the notional amount of the floor.

P is the floor premium (option premium for a floor).

T- t is the number of days to maturity.