A delta greek (belonging to the category of exotic greeks on delta) that represents the second-order partial derivative of delta with respect to volatility. Typically it is measured as the change in vanna in response to one percentage point change in volatility. Taken with respect to an option value, vanna is the second mathematical derivative of the option price with respect to changes in volatility and underlying price.

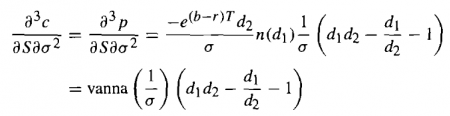

DdeltaDvolDvol is given by the following formula:

Where: T time to maturity (of the option), σ volatility, S the underlying price, X the strike price, r the risk-free rate, and b is the dividend yield (on the underlying)

It is also known as DvannaDvol.