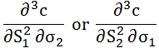

An option sensitivity (literally a cross Greek) that measures the rate of change of gamma in one underlying (of a two-asset option or a multi-asset option) in response to a change in the volatility of another underlying. Mathematically, cross vanna is given by:

For calculation, the so-called mixed numerical Greeks are used.