In the context of banking, novation refers to a method that is used by a lender to transfer a loan whereby the rights and obligations under the loan agreement are transferred. This debt transfer method involves the creation of a new contract to replace the existing one. In this sense, novation differs from assignment in that only rights associated with a contract can be transferred from seller to buyer by assignment, whereas novation entails the transfer of both rights and obligations under a contract. Novation can be arranged only with the mutual agreement of all three parties involved, i.e., the old lender, the new lender and the borrower. It leaves the old lender with no remaining obligations or rights under the old loan agreement that ceases to exist and is replaced by the new loan.

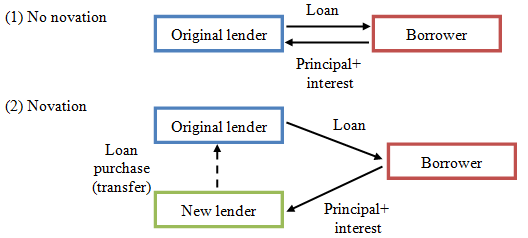

The following figure illustrates how novation works:

The original loan contract is between the original lender and the borrower. When the new lender agrees to buy the debt, a new contract is entered into involving all three parties, in which they agree that the original contract will be replaced by a new one transferring to the new lender all the rights against the borrower that the original lender had. Since the borrower is a party to the new contract, this process enables both the rights and the obligations of the original lender to be transferred to the new lender, and thus the new lender has the obligation to lend further amounts in a facility which is not fully used up. However, the borrower must also consent to the transfer. While this may be easily attained in a very small contractual agreement, it is impracticable in a syndicated loan agreement where there are several parties as well as agreements.